How To Change Name Of Weyerhaeuser Stock

Weyerhaeuser Company (NYSE:WY) has grown equally a global operator of timberlands with an ownership of more than 12 million acres in the US lonely. The company has been sustained past the thriving housing market that has grown even during the COVID-19 pandemic. Further, several factors have proven to be central drivers of returns to investors in the timberland space. Change of cost of timber, appreciation of the state value, and evolution of total biomass (from pulp to timber). Yet, in this article, I will give reasons why I am neutral with Weyerhaeuser despite organic growth prospects among demand concerns.

The numbers are great

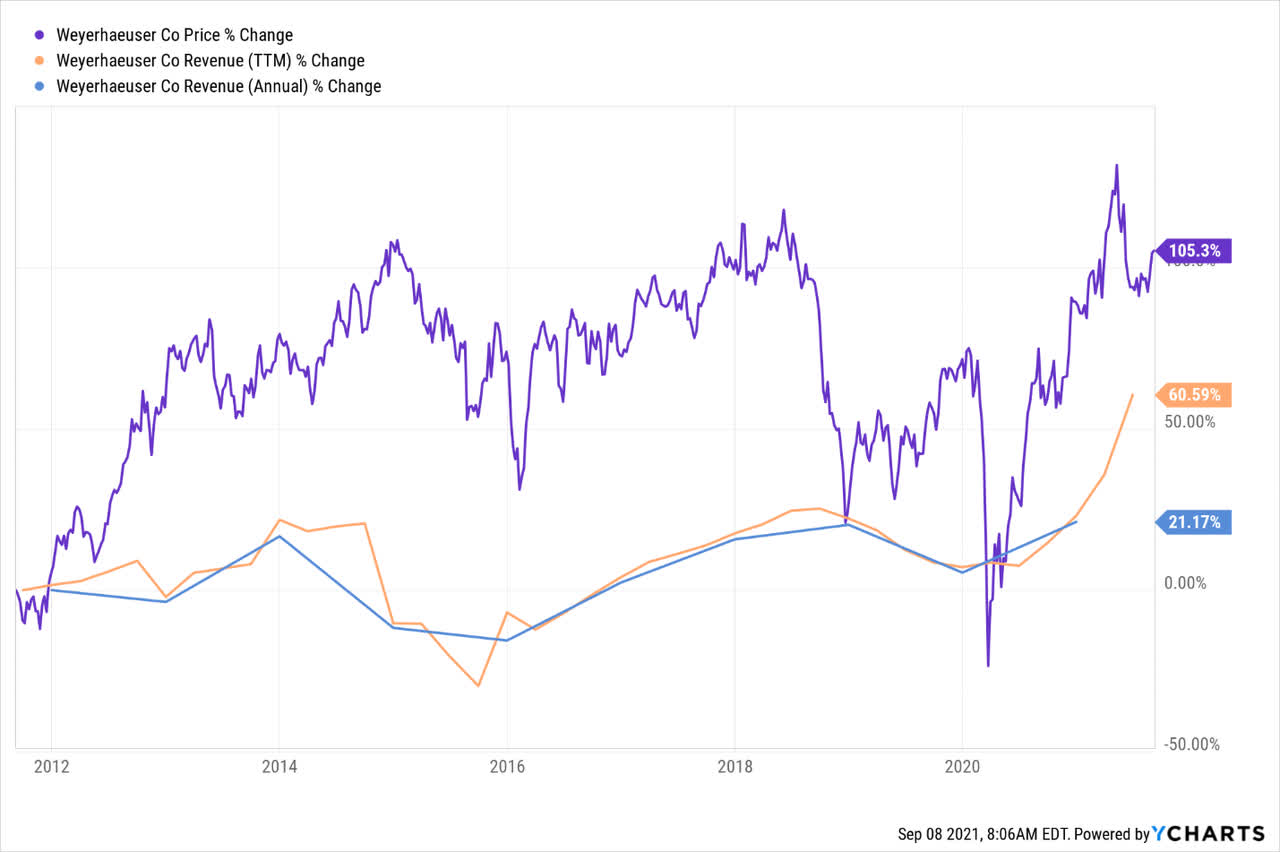

Weyerhaeuser Co's stock has risen 105.28% in the last decade. Growth was cut to xiii.65% in the past 5 years and 24.41% since September 2020. Net earnings in Q2 2021 stood at $1.0 billion and robust cash flow of more than $1.iii billion. Over the concluding 10 years, annual revenue surged 21.17% against a TTM overview of threescore.59%.

Source: YCharts

The pandemic provided fodder for the much-needed growth with the total revenue (TTM) growing to $9.823 billion from $7.532 billion every bit of December 2020. This increase was partly attributed to the surge in the Do-it-Yourself (DIY) housing project infinite.

Lumber and DIY Projects

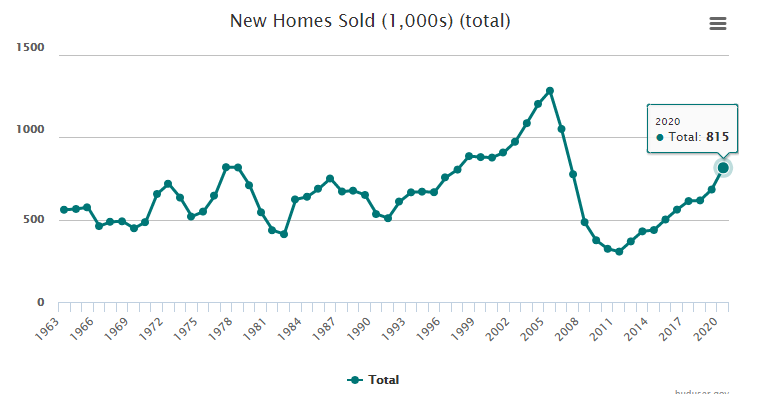

Q2 2021 saw lumber prices surge 29% as compared to Q1 2021. DIY home repairs/re-modeling activities during the pandemic helped to amend customer spending, specially on lumber. Chicago lumber prices striking their all-time loftier of $1,686 per thousand board (on May 7, 2021) later on a steep climb from March 2021.

Source: Trading Economics

However, output levels take declined amid sawmills causing a sharp drib in prices towards $518 per 1000 board as of September eight, 2021. The US construction industry is also expected to decline after topping $one.36 trillion in December 2020. Analysts are optimistic that the lumber sell-off volition end before 2021 with timber companies dusting off the low yields.

In its quarterly revenue analysis, West Fraser Timber'due south (WFG) gross profit in Q2, 2021 jumped 95.09% to $ii.544 billion. This increase represented a ascent of close to ane,000% since June 2019 when the gross turn a profit stood at $232.1 billion.

Louisiana-Pacific Corporation's (LPX) revenue (since June 2020) has increased 141.79% to $1.325 billion with gross profit up more than than 500% in the aforementioned period. In my view, LPX is a summit-performing US-timber company with a stock surge of 100% in the past yr.

In the long term, the refuse in lumber prices has strengthened the need for more edifice projects. The increased affordability status is besides a run-up to additional DIY projects after it slid in Q2 2021.

DIY giant- Home Depot (HD) increased its market capitalization to $348.63 billion and its stock rose 21.99% in the 1-year analysis. We are expecting an increment in new home sales into 2022 equally abode-furnishings become affordable.

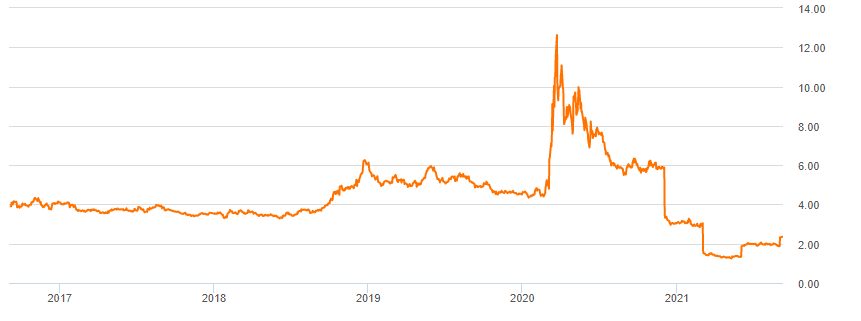

Source: Huduser

New homes sold in the U.s. increased to 815,000 in 2020 up from 306,000 in 2011 (+166.34%). Even so, the number has decreased from 1,283,000 recorded in 2005. The decline was attributed to the housing bubble that preceded the 2007-2008 recession propelled past low mortgage rates (that led to a ascent in subprime debt).

The loftier lumber prices, nevertheless, accept led to a decrease in the sale of forest products. Additionally, the ease of COVID-xix restrictions is expected to alter customer spending. WY is expecting lower EBITDA into Q3 2021.

The adapted EBITDA for WY'south timberlands concern is expected to subtract by $25 1000000 in Q3 2021. Lower sales of domestic logs will feature into 2022 including depression save productivity. In the brusque term, the company is expected to experience a wearisome recovery from the effects of Hurricane Ida that has increased operating costs in Q3 2021.

WY expects college export demand of wood to Asian countries such as Nihon as the globe continues to battle COVID-19 restrictions. However, Japan's household spending has weakened from a 5.half-dozen% fasten in July 2021- hit a 13-year high.

Cadre consumer prices also decreased 0.2% (on TTM analysis) that saw the index declined 0.2%. However, Nippon may increase its timber imports as it favors woody biomass in free energy production equally compared to coal combustion. Lower consumer prices may work to reduce the import price of timber despite a surge in demand. The government may boost local production to ease supply disruptions post-pandemic.

Low Dividend Yield

Ahead of its $0.17 per share (quarterly) dividend payment to shareholders on September 17, 2021, investors will realize a forward yield of 1.95%. Nonetheless, the yield (TTM) over the past year has declined 59.81% and -39.69% since 2016.

Source: Seeking Blastoff

The reduction of the dividend stands out as a ane-sided movement past the management to cut down expenses at the expense of shareholders. As of March 2020, the quarterly dividend payout was $0.68 per share before it was halved a year afterwards. This amount was besides decreased from $one.36 per share recorded in 2019.

Dividend payout is not commensurate with the business performance since it is declining despite the latter's improvement.

However, optimism even so abounds as the dividend may be paid based on the earnings of the prior yr (including the base dividend and an earnings bonus). Improved earnings in 2021 may push a dividend increment into 2022 or 2023.

Labor Shortage

In a recent United states of america survey, 72% of the polled contractors in the construction industry stated that poor skill sets were the leading cause of low employment rates in the industry.

Labor supply issues in the timber industry have been cited equally a leading claiming to the performance of the sector amid the COVID-19 pandemic. The recession of 2008 has weakened skill acquisition in the construction manufacture coupled with the restrictions placed during the pandemic.

Productivity in the real estate infinite requires long-term skill sets with available personnel trained for xv to 25 years. After the 2008 recession, information technology took workers near 4 years to go on with the structure training with an additional 4 years needed to acquire experience in the sector.

Therefore, 8 years after 2008 adds upwardly to the twelvemonth 2016, when construction workers were expected to increase their skillset and fit in the US task marketplace. The COVID-nineteen pandemic has also acquired this stop-and-restart preparation nature in the construction industry.

Bottom Line

No doubt, Weyerhaeuser'due south numbers are great but topline growth may exist hampered past demand concerns. While the continual refuse in lumber prices may attract customers, information technology may continue to lower output as timber companies seek to decrease aggregate supply to push up prices. Additionally, consumer spending has been altered in both the US and Canada as the COVID-xix restrictions proceed to be eased. For the moment, a neutral position will suffice as nosotros observe market dynamics surrounding the post-pandemic propulsion of the timber business organisation.

This article was written past

I have more than five years experience in the financial industry. I focus mostly in the commodities, strange substitution and cryptocurrencies. I as well write on general problems like disinterestedness inquiry, economics and geopolitics.Young man contributor Crispus Nyaga is my colleague.

Disclosure: I/we have no stock, option or similar derivative position in whatever of the companies mentioned, and no plans to initiate any such positions inside the adjacent 72 hours. I wrote this article myself, and information technology expresses my ain opinions. I am not receiving bounty for it (other than from Seeking Alpha). I have no business organization relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4454298-weyerhaeuser-company-neutral-on-demand-concerns

Posted by: stonewhicanot.blogspot.com

0 Response to "How To Change Name Of Weyerhaeuser Stock"

Post a Comment